Not a loan.

A brand-new way to put down earnest money on a property

How many real estate deals have you walked away from due to a temporary lack of liquidity?

It’s the deal of a lifetime, but you need time to get the money together. Maybe you’re waiting for cash proceeds from the sale of another property, or your investors need you to put your own money in the game first. The real estate business moves fast, and you shouldn’t have to risk losing the deal because your money is tied up elsewhere.

What is a soft deposit?

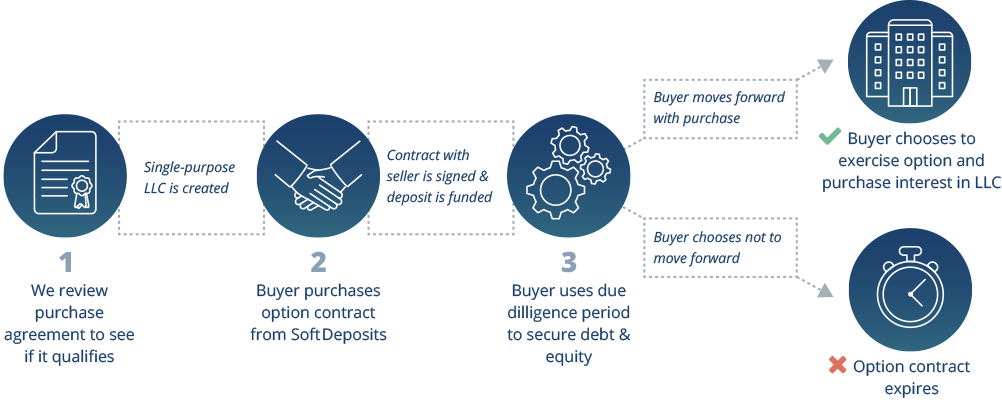

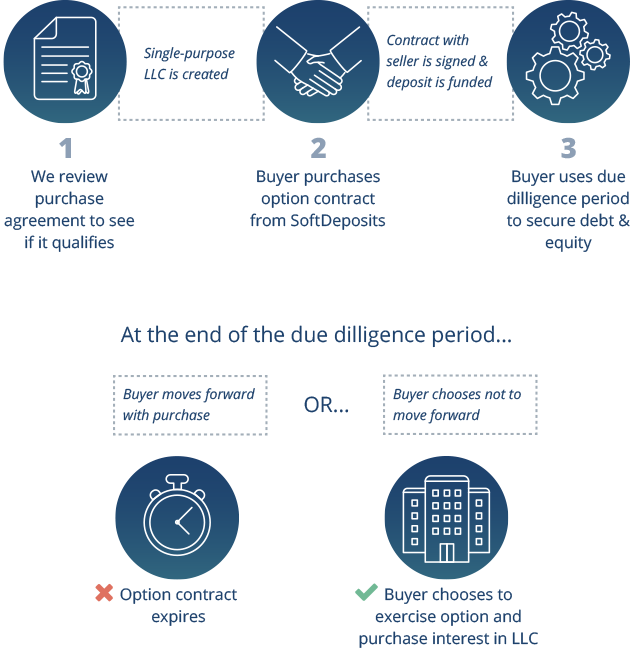

A soft deposit, also called a good faith deposit or earnest money, is a deposit made to a seller showing that a buyer is serious about purchasing a property. This type of deposit is fully refundable should the buyer elect to terminate the contract at the end of the due diligence period.

Fees are always less than 1% of the total purchase price. Regardless of whether you choose to move forward on the contract or not, fees are always less than 1% of the total purchase price (as long as the soft deposit requirement is 10% or less of the purchase price). For other deposit amounts, please contact us.